Vigeo

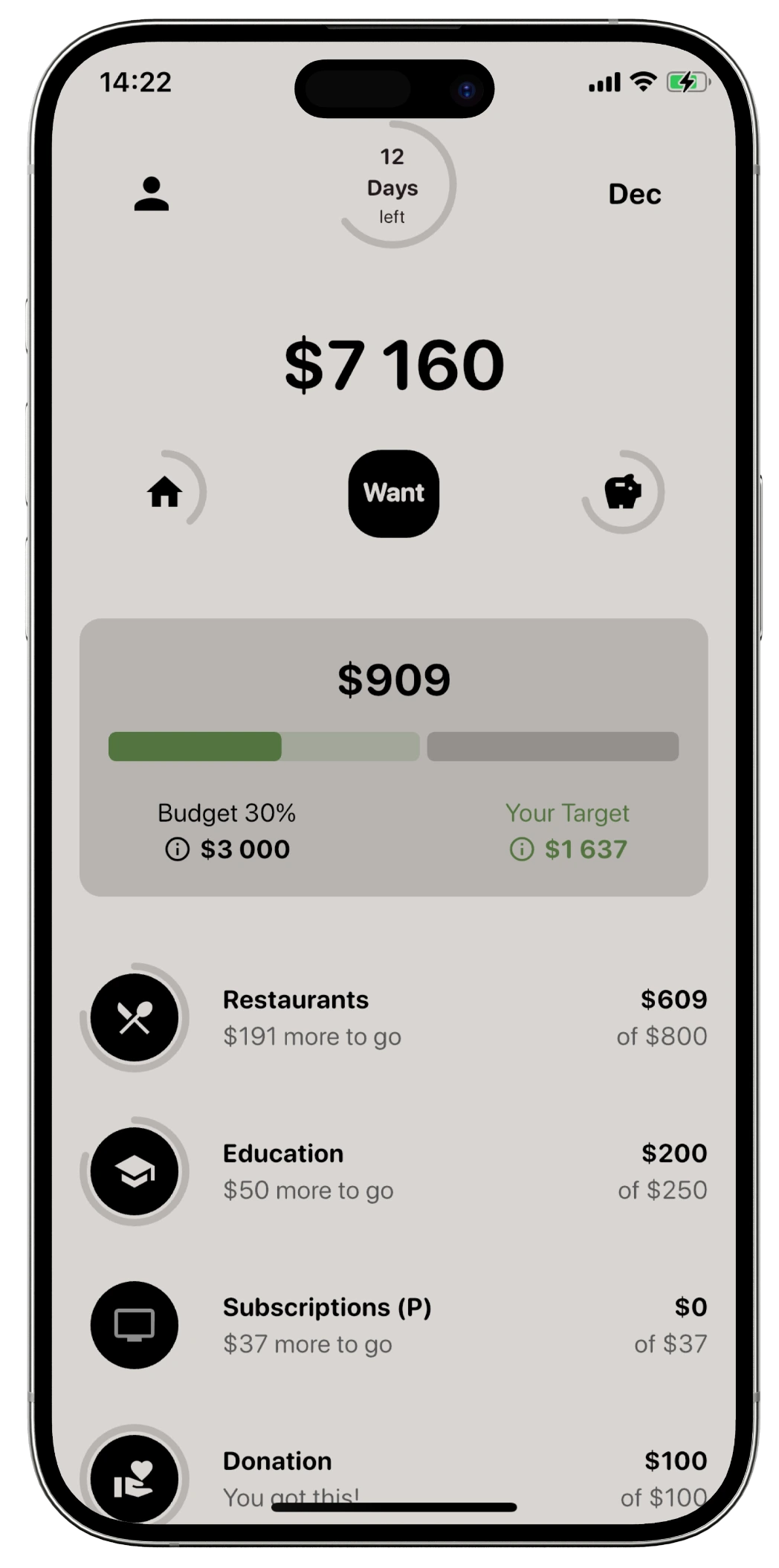

Built on years of personal budgeting experience, this tool is designed to simplify your financial planning while giving you powerful insights. Set up in minutes and use it intuitively.

Where it began?

In 2016, my wife and I took a big step—we moved into a small rented apartment together. From day one, we decided to budget as a team. I had seen my parents face financial challenges, and I was determined to avoid money-related conflicts in our relationship. We started with a notebook, recording every expense. It felt responsible and mature, but it quickly became clear that budgeting was more than just tracking numbers—it was a deeper, ongoing challenge.

Enter Google Sheets

Our early attempts at tracking expenses were far from perfect. We missed entries, forgot expenses, and our numbers rarely added up. That's when someone suggested using Google Sheets.

It felt like an upgrade. We could categorize expenses, calculate totals, and even generate charts. It brought much-needed structure to our budgeting process. However, it wasn't the ideal solution:

- Overspending on Targets: While we could set limits for categories like groceries and dining, we often discovered we had exceeded our targets only at the end of the month when we updated the sheet.

- Time Consuming Updates: We tried switching to weekly updates to stay on track, but the process was too tedious to sustain.

Eventually, Google Sheets became more of a chore than a solution. Just as we were about to give up, something exciting happened.

The Banking App Era

A banking app entered our lives, and it felt revolutionary:

- Automatic categorization saved us hours.

- Budgeting per category became easier.

- Joint accounts so we can spend from one place

But, as good as it was, problems remained:

- Categories were often incorrect.

- Automated transactions felt out of sync with our budgeting goals.

- Despite having access to detailed statistics and charts, we lacked a strategy for improving our savings.

- Cash transactions still had to be entered manually in Google Sheets.

Despite the improvements offered by the banking app, we still relied on Google Sheets to get a complete view of our finances. However, even this combined approach had a significant flaw: it didn't account for long-term expenses.

The Big Picture Problem

Budgeting monthly gave us clarity—but only on a surface level. Major expenses — like new smartphones (every 3 years), car tires (every 2 years), or home renovations (every 7 years), were often overlooked. These "predictable" costs weren’t fully accounted for, leaving gaps in our financial planning.

We realized that to truly understand our finances, we needed to integrate these predictable expenses into our budget. Whenever an unexpected big expense happens, we take into account when was the last time it happen, adjusting for inflation. For future planning we set up monthly payments for it. For example if a renovation of 10 000 happens every 7 years. The months of 7 years are 84. We divide 10 000 by 84 and it turns out that we should put aside 120 every month for this. If we decide to not renovate later that's fine.

Strategic Savings

We’ve always loved the idea of passive investing and wanted to ensure that every month, a fixed amount automatically went to our broker. This led us to a strategy of fixed and relative savings:

- Priority Savings: Essential or goal driven savings, like investments, had a set amount.

- Flexible Savings: Non-essentials, like vacations, hobbies, and shopping, were tied to what we saved overall.

For example we can set 50% for vacations, 35% business and 15% hobby from after what is left from spending and priority savings. This approach motivated us to save more—knowing that the better we saved, the better our experiences could be and we always plan our vacations in advance, stress-free.

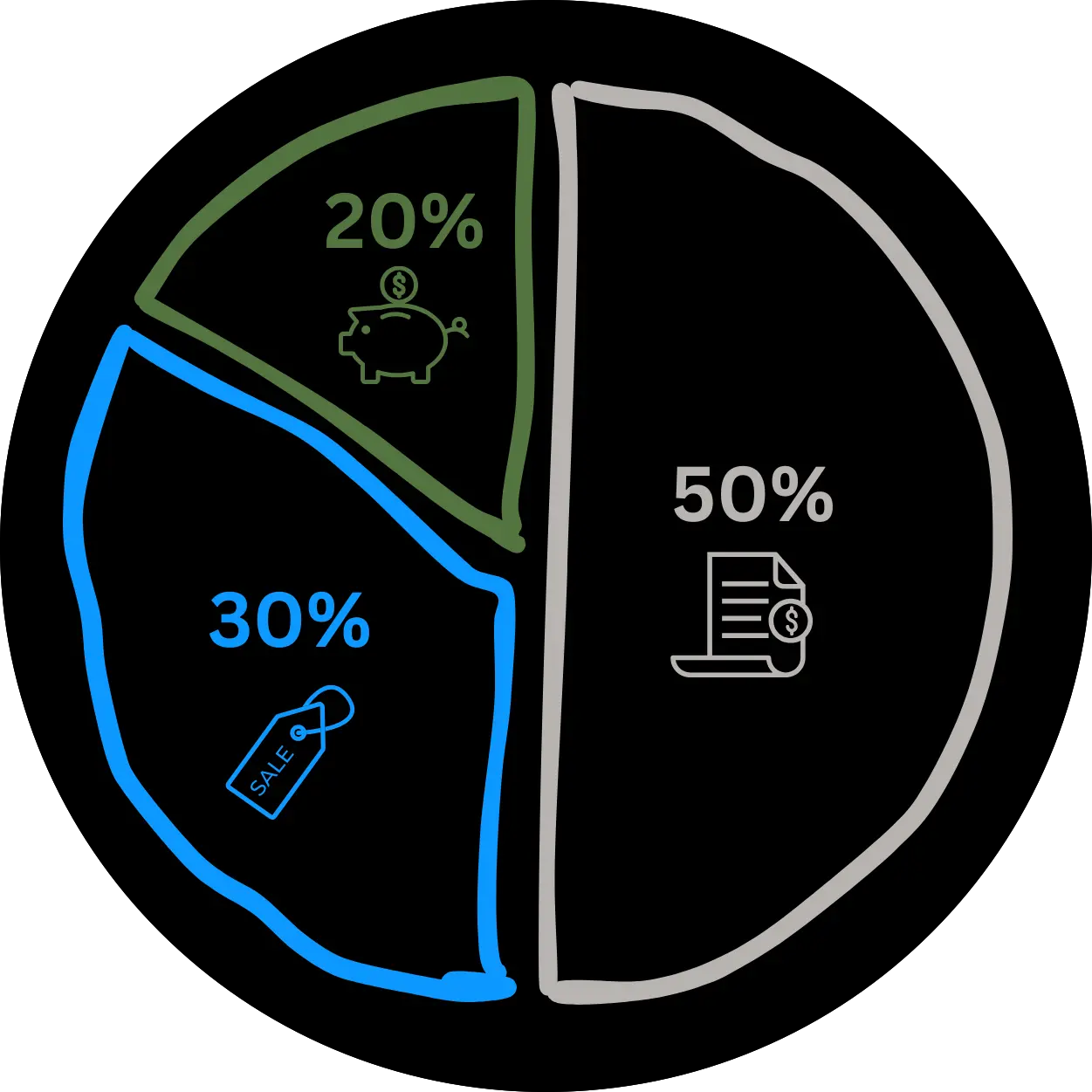

The rule that simplified our budgeting

One day, I stumbled upon a Khan Academy course on budgeting for 7th grade. 50/30/20 rule (I wish I'd learned this sooner!)

- 50% on needs (housing, utilities, groceries).

- 30% on wants (dining out, hobbies).

- 20% on savings.

Instead of having a budget limit for every category, this divided our spending into two parts: needs and wants. This further simplified our budgeting experience. However, instead of strictly following this rule, we adapted it to our approach. We aimed to spend as little as possible on needs, but not more than 50%. If we did exceed 50%, we make up a plan to pull it down within six months. And then it worked.

The same went for wants: we aimed to spend as little as possible, but not more than 30%. Everything looked really simplified and nice. But something was still missing.

The Missing Piece

We weren’t guessing anymore—we had a budgeting system that worked for us. But it was trapped in Google Sheets.

Each month ended with frustration, exporting and merging data by hand. No app fit our way of thinking. So I used my programming skills to build something different: a tool shaped by experience, not assumptions.

Vigeo prioritizes essential features over unnecessary complexity.

Join Our Community

Hi, I’m Yanko—and I’m building a budgeting tool that’s truly helpful, refreshingly simple, and grounded in real-world experience. But I can’t build it in a vacuum. I need your voice. You can start by sharing your budgeting experiences in this quick poll (takes 30-60 seconds).

As a thank-you, I’m offering perks for the first 500 people who actively help shape the app. That means bonuses, early access, direct influence on features, and more.

Join our Beta Community by 👉 sending us an email or text us in Discord

Let's redefine financial awareness—together.

Vigeo Might Not Be For You

We value your time and don't want to try a product that is not for you! Vigeo may not be ideal for you if ...

You want everything done for you automatically

If you're looking for full automation with zero input, Vigeo may not be the right fit. We believe that a bit of intentional friction builds awareness, confidence, and better decision-making. It's not just data entry—it’s a mindful rhythm that puts you back in control of your money.

You're just looking to track your spending, not actually plan your finances

Real progress starts with a plan. Vigeo is not a tool for looking back—it’s a tool for looking forward. Together with your budgeting partner, you’ll define goals and map your journey. Because the only way to get somewhere is to first decide where you want to go.

You prefer budgeting on a weekly or quarterly basis

Vigeo is rooted in monthly planning, because that’s how real-life income and bills flow. If your budgeting philosophy is rigidly tied to other time frames, this app won’t feel natural.

You expect an all-in-one platform that handles investing, bill payments, or crypto

We focus on doing one thing exceptionally well helping you make better financial decisions through budgeting. If you're looking for a financial Swiss Army knife, we’re not it—and that’s intentional.

You’d rather settle for a free app that does a mediocre job than invest in a tool that truly works

There are plenty of free apps that offer surface-level features. Vigeo is for those who value clarity, quality, and results—and understand that change often requires a small investment.

Vigeo Is for You

If You Want to…

Stop feeling anxious every time you look at your bank balance

You’re tired of that pit in your stomach. Vigeo helps you feel in control, not surprised.

Finally feel like you understand your money, instead of reacting to it

We believe that awareness is the first step toward confidence. You’ll stop guessing and start making calm, clear choices.

Spend more on what matters to you without the guilt

It's not about saying “no” to everything. It's about saying “yes” to what aligns with your values—and finally feeling good about it.

Build peace of mind by knowing you’re prepared for the unexpected

Emergencies don’t have to become crises. Vigeo helps you build the kind of financial resilience that brings you calm—even in chaos.

Replace budgeting burnout with a simple, sustainable rhythm

You’ve tried complicated tools or spreadsheets. Vigeo keeps things light, so you can actually stick with it.

Feel progress—real, visible progress—month after month

You don’t need charts to tell you it’s working. You’ll feel the difference in your day-to-day life.

Get smarter with your money without needing a finance degree

You won’t find jargon here—just clear guidance that helps you make better decisions, one step at a time.

Live with more freedom and less financial stress

That’s the goal. Not just better numbers, but a better life.

Join our Discord Community

JoinWant to be part of shaping the future of Vigeo? Join our Discord server for exclusive early access to updates, features, and announcements. Your feedback is crucial to our development process, and our Discord is the best place to share your thoughts and directly influence what we build next.